The 15-Second Trick For Pvm Accounting

The 15-Second Trick For Pvm Accounting

Blog Article

The Best Guide To Pvm Accounting

Table of Contents5 Easy Facts About Pvm Accounting ShownThe 8-Second Trick For Pvm Accounting6 Easy Facts About Pvm Accounting ExplainedPvm Accounting Can Be Fun For AnyoneSome Known Facts About Pvm Accounting.Rumored Buzz on Pvm AccountingPvm Accounting - An Overview

Are they a licensed public accountant? Just how much does it cost to employ an accountant? The quantity can differ extensively depending on the kind of accounting professional you hire and the services you require.

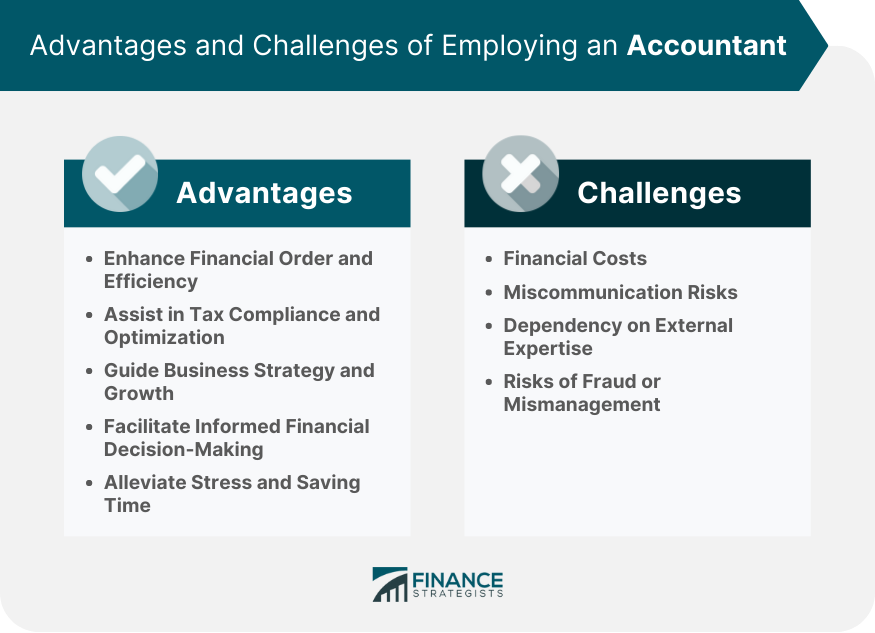

In the brief term, accounting professionals will save you valuable time. In the long-term, this added time indicates that you're freed up to concentrate on whatever you need to do to help your business grow.

The smart Trick of Pvm Accounting That Nobody is Talking About

It's worth noting that not all accounting professionals hold the exact same credentials. A State-licensed Accountant (CERTIFIED PUBLIC ACCOUNTANT) is an accountant that has actually passed a particular test and completed a series of coursework across a three-year training course. Therefore, if you employ a CERTIFIED PUBLIC ACCOUNTANT, you can be assured that their work depends on a specific criterion.

Professional accountants have the skills, proficiency, experience, and knowledge to submit effective tax obligation returns, keep your books in order, and to aid you avoid a dreadful audit - https://rndirectors.com/author/pvmaccount1ng/. They can aid you find means to take full advantage of profits or philanthropic contributions, and might also have the ability to locate tax obligation breaks that save you and your company a small fortune

Pvm Accounting Fundamentals Explained

However, we pay experts to assist with advertising and marketing, IT, and legal issues even if we can do things ourselves. It isn't practically the task being done, but rather the top quality of the work. A professional accounting professional will certainly be able to take the details you provide, including your spending plan and expenses, receipts, billings, wage slides, and details of checking account, financial investments, shares, and financial obligations, and settle them into one location.

Also if you really feel that you have a head for figures, it can be worth working with a professional to avoid costs hours attempting to correct mistakes at a later day. The differs. Typically, the cost is around $350 per hour across the country, although costs range $60 $400 depending on location and service.

A Biased View of Pvm Accounting

The cost to execute these tasks should be seen against the cost if you get it incorrect, or if you need to go with an audit or examination and discover that you do not have actually all the needed info handy. Besides, errors cost both time and moneyas well as major stressto fix.

Employing an accountant that understands your state's details peculiarities when it concerns filing your tax return or maintaining accounts for your organization is one of the most effective way of keeping the best side of the law. While some individuals discover that their taxes are very uncomplicated, others have a much more complex set-up.

An excellent accountant will certainly be able to listen to your objectives and resolve them versus the truth of your financial scenario (https://www.coursera.org/user/1eefa8fc4c13ac004f2f428d897eaf25). This can consist of points like saving up for development, providing fringe benefits for employees, and preparing yourself for retirement. There are likewise much more complicated monetary circumstances for service owners that experts can encourage on: establishing up a count on fund, or making a decision on a

An Unbiased View of Pvm Accounting

An expert that takes an excellent sight of your full economic accounts will certainly be able to save you a terrific offer in both money and time.

6 Simple Techniques For Pvm Accounting

Tackling a franchise business is a preferred technique of launching in business, specifically in locations such as car detailing, cosmetics supply, lawn-mowing, messenger delivery operations and fast-food restaurants. With a franchise business, you can still be your own boss, yet in return for a share of the revenue or business equity, the franchise business business will sustain you with brand marketing, sales, item supply and other concerns.

All about Pvm Accounting

If you can afford it, hiring a CPA is most likely your best choice under any situations. Attempting to inform yourself on altering tax obligation legislations, recognizing the different reductions you certify for and staying present with filings can distract you from what's Check Out Your URL most crucial: running your business.

Report this page